tax identity theft def

To steal money from existing. Noun the illegal use of someone elses personal information such as a Social Security number especially in order to obtain money or credit.

Learn About Identity Theft And What To Do If You Become A Victim

The most common method is to use a persons authentic name address and Social Security Number to.

. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. If a cybercriminal uses your personal information to file a tax return in your name theyre committing tax identity theft. Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return.

Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like. Youll use IRS Form 14039 to. This is done so that the.

Take Action if You Are. Synthetic fraud is a new form of identity theft in which a fraudster creates a false identity. Kohls Department Stores Inc.

Ad Get your 3B Annual Credit Scores Reports Credit Monitoring Plus a Lot More. Tax identity theft is when someone uses your personal information namely your Social Security number to file a tax return in your name. Sign Up For a 30-Day Trial Today.

Taxpayer Guide to Identity Theft Know the Signs of Identity Theft. Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. Lost ID or SSN.

Losing personal identification is a very serious problemIf. Identity theft is a term that covers a variety of crimes in which someone steals another persons personal information such as their Social Security number or bank account. Complete an IRS Identity Theft Affidavit.

Identity Theft Victim Assistance IDTVA IRS Definition If you learn you. You might think youre in the clear because you. Ad Trusted Review of Top ID Monitoring Services.

Sign Up For a 30-Day Trial Today. Identity Theft is the assumption of a persons identity in order for instance to obtain credit. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return.

Stealing your identity could mean using personal information without your permission such as. An identity thief might open an account in someones name file taxes on their behalf to receive the refund or use their credit card number to make online purchases. Identity Theft is the assumption of a persons identity in order for instance to obtain credit.

Criminal identity theft occurs when someone cited or arrested for a crime presents himself as another person by using that persons name and identifying information. Ad Get your 3B Annual Credit Scores Reports Credit Monitoring Plus a Lot More. How does tax identity theft happen.

To obtain credit cards from banks and retailers. Identity theft is when a person steals your personal information to commit fraud. Kohls Department Stores Inc.

People often discover tax identity theft when they file their tax returns. Tax identity theft happens when someone uses your personal informationto file a tax return claiming the fraudulent returns are yours. Tax Identity Theft.

Criminal identity theft can be very difficult to detect. Ad Trusted Review of Top ID Monitoring Services. Intelligently Detect and Respond to Compromised Accounts using Responsive Cloud-Based AI.

Ad Use Strong Authentication and Real-Time Access Policies to Grant Access to Resources. In addition to promptly responding to IRS communications here are a few more steps you could take. You may not know youre a victim of identity theft until youre notified by the IRS of.

In this type of exploit the criminal files a false tax return with the Internal Revenue. Financial identity theft seeks economic benefits by using a stolen identity. Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name.

Here are some signs that you should look out for. Comparisons Trusted by Over 45000000. Many people dont know that their.

Identity theft occurs when someone steals your identity to commit fraud. Agreed to pay a civil penalty of 220000 to settle Federal Trade Commission allegations that the retailer violated. Tax identity theft edit One of the major identity theft categories is tax identity theft.

Comparisons Trusted by Over 45000000. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work.

Learn About Identity Theft Chegg Com

Irs Notice Cp01 Identity Theft Claim Acknowledgement H R Block

What Is Identity Theft Definition From Searchsecurity

Identity Theft Definition What Is Identity Theft Avg

Irs Notice Cp01s Message About Your Identity Theft Claim H R Block

Tax Identity Theft American Family Insurance

Learn About Identity Theft Chegg Com

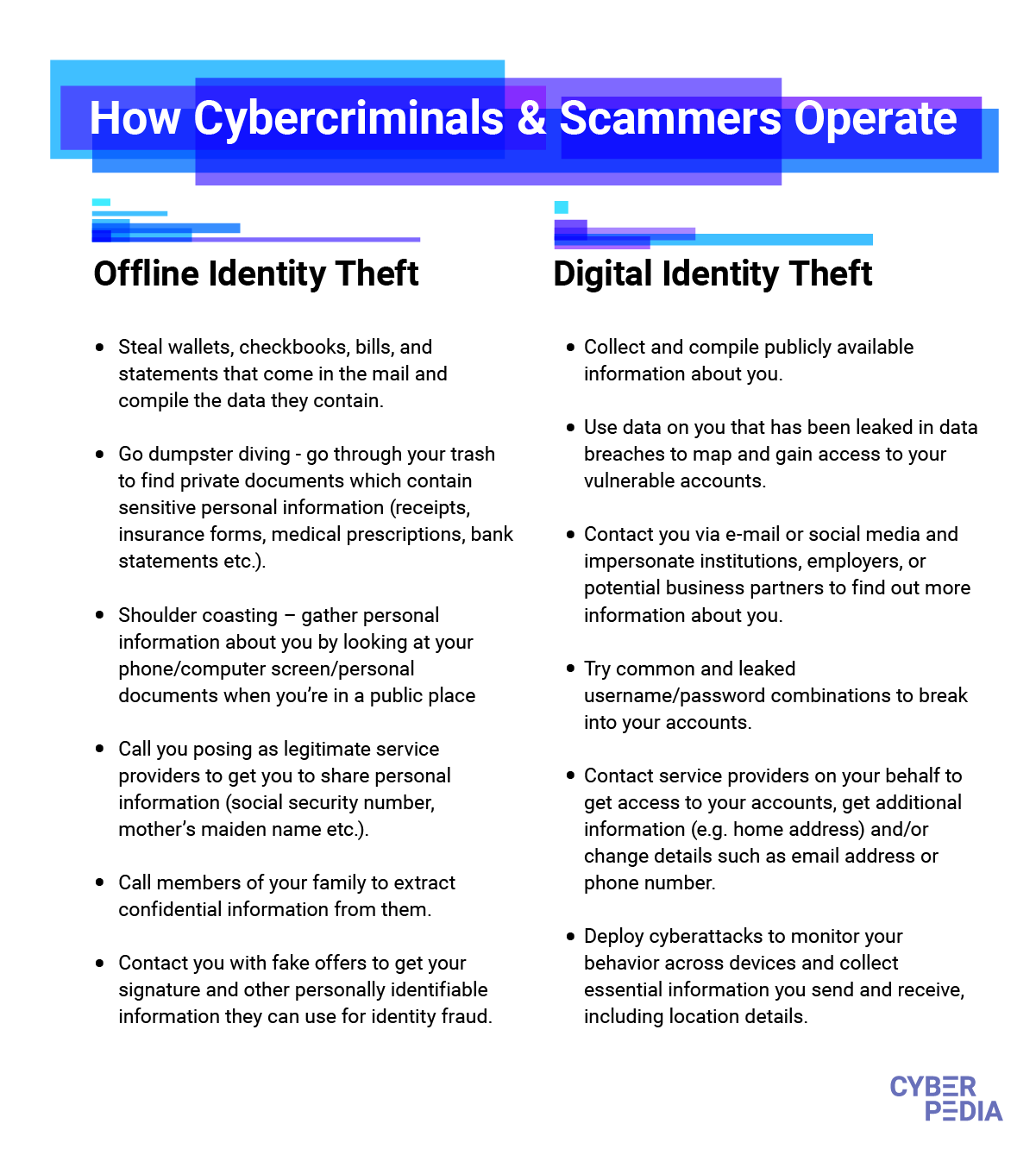

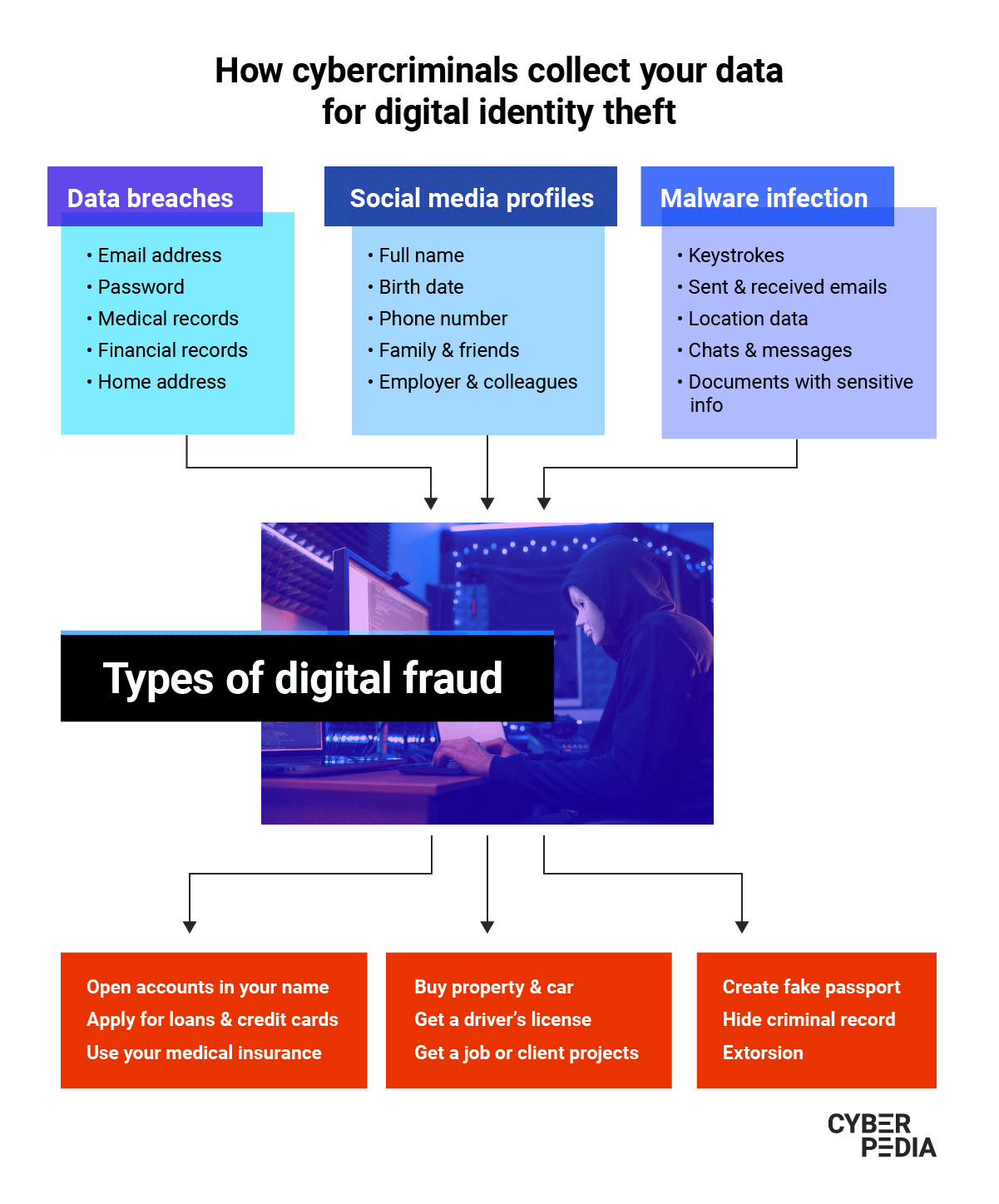

What Is Digital Identity Theft Bitdefender Cyberpedia

Irs Notice Cp01c We Verified Your Identity H R Block

Types Of Identity Theft And Fraud Experian

What Is Identity Theft Definition Bankrate

Identity Theft Definition How To Prevent How To Report

What Is Identity Theft Definition Types Protection Study Com

What Is Digital Identity Theft Bitdefender Cyberpedia

What Is Identity Theft Webopedia Reference

What Is Identity Theft Definition Bankrate

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)